A check register is a valuable tool for keeping track of your checking account activity. Account balances, deposits, withdrawals, and pending transactions may all be viewed in real time, and any changes can be reflected immediately. Keep your records, even if your bank is reliable, in case you know more about prospective transactions than they do.

Precisely What Is a Check Register?

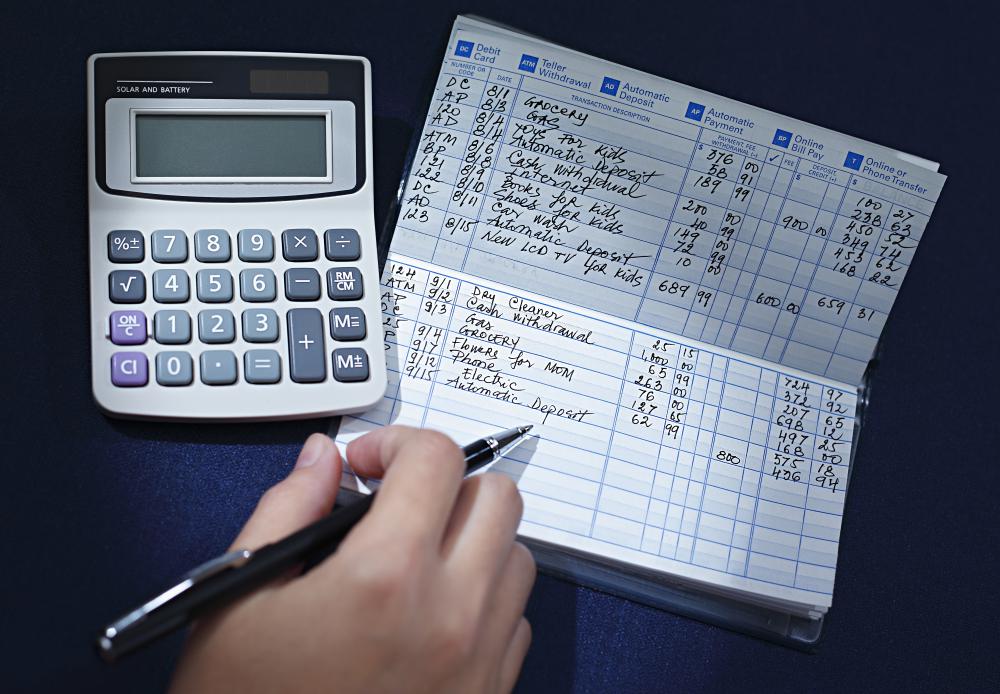

Keeping track of your checking account activities and the current amount will help you avoid overdrawing your account. These records can be kept on paper, in apps, or spreadsheets. You update the list as you spend money or add dollars to your account. Occasionally comparing your register with your financial data is also a good idea.

The check registers that come with each batch of checks are handy for keeping tabs on your finances. 2 You may personalize your system and keep tabs on your finances without having to buy new registers if you opt for an electronic or DIY solution for your checkbook.

What's The Point of Keeping Your Checkbook in Balance?

Keeping a record of your transactions and balancing it is a brilliant idea, even if much of this information is now available at the press of a mouse. Reconciling your account, commonly known as balancing your checkbook, is comparing your records of financial activities with those shown on your bank statement to ensure a consistent picture of your financial situation. Keeping and regularly balancing such a record is essential for several reasons:

- When people still used paper checks, it sometimes took weeks for a single check to clear. Making a habit of recording your check payments as you make them and comparing your account balance to the bank's statement can prevent you from being caught off guard by the appearance of a long-forgotten check.

- Errors on the part of banks are unusual, but they can happen, and balancing your checkbook is one way to detect them early.

A Guide To Checkbook Balancing

In the past, balancing your checkbook was a monthly ritual that occurred when you received your printed bank statement. The bank statement would be used to verify the accuracy of the transactions you recorded in your traditional paper checkbook register. This task may not appear the same as it did when we were kids, but the fundamentals of the work haven't changed much.

Alternatives For Digital Balancing

Traditional checkbook balancing involves constantly carrying around a paper check register and manually entering all of your transactions. Furthermore, it presupposed that most of your account's inflows and outflows occurred via physical checks.

From automated teller machines and mobile deposits to preauthorized card payments and direct deposit paychecks, modern conveniences have greatly expanded the range of possible financial dealings. Due to these factors, most of today's consumers rely on electronic methods for checking account balances.

Daily Online Banking

You may get most of the same benefits of keeping and balancing a check register by just accessing your account online daily since your bank will update the transactions that clear your performance in real-time. This will give you a constant view of your current balance and help you to see flaws and errors within 24 hours of creating them.

Employing an Account Consolidator

Several applications, like Mint.com and Personal Capital, offer automated bank account tracking. These aggregators provide a bird's-eye view of your financial accounts in one convenient location, including bank and credit card balances, loan payments, and even contributions to a 529 plan for education.

This type of aggregator will keep track of everything for you; you must review it regularly and cross-reference it with your bank records to ensure accuracy.

A Computerized Accounting System

If you'd enjoy the accountability of documenting your purchases but need a little structure, you can try utilizing an accounting tool, such as Quicken or YNAB. While these apps may fill in some of your transactions automatically, you'll still be able to conduct a lot of manual logging on your computer or mobile device.

Maintaining A Stable Financial Picture Is Crucial

Even though it's becoming increasingly rare to use a physical checkbook, it's still crucial to your financial well-being to be able to reconcile your accounts regularly.

It is becoming increasingly important to monitor the flow of your funds, especially as more and more of your financial transactions take place digitally, using methods such as mobile deposits and automatic bill payments.

You can avoid financial surprises and prepare for the future by keeping tabs on your money's comings and goings, which is why keeping track of all your transactions is essential.