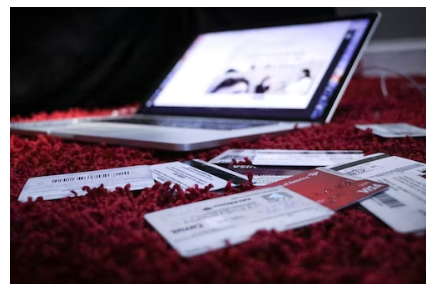

However, it is easy to make credit card mistakes and pay the price later. College students are especially prone to making costly errors with their credit cards, as they often lack the experience and knowledge to make smart financial decisions.

The most typical credit card errors made by college students are covered in this article, along with guidance on how to avoid them. We will also provide useful tips to help college students make the most of their credit cards and stay out of debt.'

College students should care about building a credit score because when people want to borrow money, buy a car, or rent an apartment, a high credit score can be helpful.

One of the key methods for enhancing credit scores is to avoid making credit card mistakes, especially mistakes that college students make. Common credit card mistakes that college students make include not making payments on time, overspending, using the wrong credit card for the wrong purchase, and not understanding the terms and conditions of the card.

To build a good credit score, college students should be aware of these mistakes and take steps to avoid them.

They should also make sure to pay their credit card bills timely, keep balances low, and read the terms and conditions of any credit card they use.

By taking these steps, college students can build a good credit score, which will benefit them in the future.

Benefits of Using Credit Cards

1. Easier to Track Spending: Credit cards are convenient and make sure that you track your spending easily. By utilizing online or mobile banking, you can review your credit card statements and know exactly where and when you used them.

2. Build Credit: Credit cards, when used properly, can aid in credit establishment. You may establish a solid credit history by paying your bills on time and keeping your debt to a minimum.

3. Rewards: Many credit cards offer rewards such as cashback or points that can be used for travel, merchandise, and more.

4. Fraud Security: In the event of fraud or an unlawful charge, credit cards provide more safeguards than debit cards.

5. Use Anywhere: Credit cards are accepted almost everywhere and are more convenient than carrying cash.

6. Purchase Insurance: Purchase safeguard plans are provided by many credit cards and can assist in reimbursing you in the case that an item is lost, stolen, or destroyed.

7. Credit Card Mistakes to Avoid: It’s important to avoid common credit card mistakes, such as overspending, making late payments, exceeding your credit limit, or taking out a cash advance.

8. Credit Card Mistakes College Students Make: College students should also be wary of opening too many credit cards, not paying the full balance each month, and not understanding the terms and conditions of credit cards.

9. Emergency Funds: Credit cards can provide an emergency source of funds when cash isn’t available.

10. Convenience: Credit cards are convenient and easy to use. They are accepted nearly everywhere and can be purchased online or over the phone.

Common Credit Card Mistakes College Students Make

1. Not Paying Credit Card Balances in Full: College students often make the mistake of not paying their credit card bill in full each month, instead carrying a balance and incurring additional interest charges.

2. Maxing out Credit Cards: College students are often tempted to take on more credit card debt than they can realistically handle, maxing out their cards and quickly becoming overwhelmed by debt.

3. Paying Only the Minimum Balance: College students should be aware that paying only the minimum balance due on their credit card bill will not help them pay off their debt and can lead to serious financial hardship.

4. Using Credit Cards to Make Impulse Purchases: College students often make the mistake of using their credit cards to purchase items they don’t need or can’t afford, leading to increased credit card debt.

5. Not Reading the Fine Print: College students often don’t take the time to read the fine print of their credit card agreement, leading to unexpected fees or charges.

6. Not Monitoring Credit Card Activity: College students should monitor their credit card activity regularly to ensure there are no unauthorized charges or discrepancies.

7. Not shopping around for the Best Credit Card: College students should take the time to compare different credit cards to find one with the best terms and features for their needs.

8. Not Understanding Credit Card Rewards: College students should understand the rewards offered by their credit cards and use them to their advantage.

9. Not Paying Attention to Credit Card Interest Rates: College students should pay attention to the interest rates on their credit cards and look for a credit card with a reduced rate.

10. Not Keeping Track of Credit Card Spending: College students should keep track of their credit card spending and ensure it stays within their budget.

How to Avoid These Mistakes

1. Recognize your credit card conditions of Use: Prior to using a credit card, confirm that you are aware of all of the contract terms, such as the interest rates, charges, and payback schedule.

2. Refrain from Spending Too Much: One of the top credit card mistakes made by college students is spending too much money. Use your credit card only for necessary expenditures, and be sure to stay to your budget.

3. Keep Track of Your Spending: It’s important to keep track of your credit card spending to ensure you are not overspending. Regularly review your credit card statements, and keep track of all your purchases.

4. Pay Your Credit Card Balance in Full Each Month: College students should strive to pay their credit card balance monthly to avoid high-interest charges.

5. Don't Ignore Credit Card Transactions: Skipping payouts may result in late penalties, increased interest rates, and a possible lowering of your credit score. Pay attention to making prompt payments on all bills.

6. Don’t Use Your Credit Card for Cash Advances: Cash advances are expensive and should be avoided. The rate of interest is substantial, and each advance also carries a separate cost.

7. Don't make unauthorized transactions using your credit card: Use your credit card only for essential transactions. Unnecessary purchases can lead to high levels of debt and should be avoided.

8. Protect Your Credit Card Data: College students should safeguard their credit card data. When making online transactions, always use secure websites and avoid disclosing your credit card details to others.

9. Avoid Opening Too Many Credit Cards: College students may run into issues if they have too many credit cards. Make sure only to open the number of credit cards that you need.

10. Monitor Your Credit Report: College students should monitor their credit reports regularly to make sure that there are no errors or fraudulent activity.

Conclusion

In conclusion, credit cards can be a great tool for college students to begin building their credit and financial future. If utilized improperly, they might nonetheless be harmful.

College students should be aware of the common mistakes they might make, such as taking on too much debt, not making payments on time, and not budgeting properly.

By understanding these mistakes and following simple tips, such as setting a budget and reading credit card statements, college students can reap the benefits of having a credit card while avoiding the pitfalls.